CA 00 25–AUTO DEALER COVERAGE FORM ANALYSIS

(October 2019)

|

|

Vehicle dealerships are unique because the lines between their general liability and automobile liability exposures blur and overlap in many areas. To address this, the Insurance Services Office (ISO) developed CA 00 25–Auto Dealers Coverage Form. It covers both exposures under a single coverage form while eliminating coverage gaps and overlaps. It covers premises liability, products liability, automobile liability, and physical damage to covered autos, as well as garagekeepers coverage for customers’ autos. A number of endorsements are available to broaden or restrict coverage.

Related Article: ISO Auto Dealers Coverage Form Available Endorsements and Their Uses

This analysis is based on

the 10 13 edition which is the initial edition of this coverage form. This form

replaces the CA 00 05–Garage Coverage Form.

CA 00 25–AUTO DEALERS COVERAGE FORM ANALYSIS

CA 00 25 opens by defining the terms you or your as the named insured and we, us and our as the insurance company providing the coverage. Named insured is not defined. As a result, it means only the entities on the declarations.

SECTION I–COVERED AUTOS COVERAGES

Numerical symbols are used to describe which autos are covered and for what coverages. These symbols are defined in the Description of Covered Auto Designation Symbols.

The Auto Dealers Declarations contains spaces next to each of the business auto coverages in which symbols can be entered. The entry of a symbol means that the coverage applies. The entered symbol explains what types of vehicle have that coverage.

Related Article: CA DS 26–Auto Dealers Declarations

A. Description of Covered Auto Designation Symbols

21–Any Auto

This is the broadest symbol designation and has no limitations or restrictions. Vehicles defined as autos in this coverage form are covered, subject to certain exclusions and conditions. Because of the broad scope of the coverage provided, many insurance companies are reluctant to use this symbol. Even if a company uses it for liability, it may not do so for physical damage. No other symbol should appear in the same box when Symbol 21 is used.

Note: See Section VI–Definitions for the definition of auto.

22–Owned Autos Only

This symbol means that any auto the named insured owns is covered, including those it acquires after the inception date. In addition, any owned or non-owned trailer pulled by an owned vehicle is covered if this symbol is used with covered autos liability coverage.

Note: See Section V–Definitions for the definition of trailer.

23–Owned Private Passenger Autos Only

All private passenger type autos that the named insured owns are covered when this symbol is used. This includes any private passenger type vehicle it acquires after the inception date.

Note: The term private passenger type is not defined. Pickups, panel trucks and vans that are not used in business are rated as private passenger according to the ISO rating rules but the coverage form itself does not define the term private passenger auto.

24–Owned Autos Other Than Private Passenger Autos Only

This symbol means that all autos that are not considered to be private passenger types are covered if they are owned by the named insured. Those that are acquired after the inception date are also covered. Similar to Symbol 22 above, the covered auto liability coverage provided is extended to non-owned trailers pulled by this type of owned vehicle.

|

Example: Paula's Pre-Owned Autos is insured under CA 00 25–Auto Dealers Coverage Form. Paula's sells and services autos. A new mechanic takes a one-ton stake truck, visits several junkyards, and purchases some used parts and equipment. By the time he gets to the last one, the truck is already full, but he still has to pick up an engine block needed that day. The junkyard owner loads the engine block on one of his trailers and attaches it to Paula's truck. Because the trailer is attached to the truck, Paula's Auto Dealers Coverage Form will respond to any covered auto liability accident involving that trailer. |

|

25–Owned Autos Subject To No-Fault

An owned auto that is licensed or garaged in a state where no fault coverage is available is covered for no-fault coverages but only if the particular auto is required to have such coverage. Coverage also extends to such autos acquired after the inception date.

26–Owned Autos Subject To a Compulsory Uninsured Motorists Law

This symbol means that any auto the named insured owns that is garaged or licensed in a state that mandates uninsured motorists coverage is covered. It also applies to any auto acquired after the inception date.

This symbol does not apply to vehicles licensed or operated in states that allow the named insured to formally reject uninsured motorists coverage.

Related Court Case: Test Drive Accident Spurs Coverage Dispute

27–Specifically Described Autos

Only autos specifically scheduled that have a premium charge are covered. Similar to Symbol 22 above, the covered autos liability coverage provided extends to any owned or non-owned trailer pulled by this type of owned vehicle.

28–Hired Autos Only

This symbol means that autos the named insured leases, hires, rents or borrows are covered. This symbol has a significant limitation. It does not include leased, hired, rented, or borrowed vehicles that are owned by an employee, partner, LLC member, or members of any of the preceding groups’ households.

29–Non-Owned Autos Used In Your Auto Dealership

This symbol means that autos the named insured uses in its business that it does not own, lease, hire, rent, or borrow are covered. Autos owned by employees, partners in the case of a partnership, members in the case of limited liability companies, or members of the preceding group’s households are included. Covered status exists only while those non-owned autos are used in the named insured’s auto dealership business.

|

|

Example: Paul recently started his job at The Friendly Dealer, was learning the ropes, and his boss asked him to make a run to the deli for lunch. The boss and several employees wrote down their orders, Paul called the order in, and then headed out to pick them up. While driving back, a drink lid popped off and he bent over to readjust it. At that exact moment, the car in front of him stopped and Paul rammed it, setting off a chain reaction that eventually damaged six vehicles. The drivers brought claims against Paul and The Friendly Dealer upon learning that Paul was traveling on company business. Friendly's owner and his insurance company are still discussing whether the lunch run qualifies as part of the auto dealer’s business. |

30–Autos Left With You

for Service, Repair, Storage or Safekeeping

This symbol means that customer autos, including autos of employees and

their household members, that are left with the named insured for service,

repair, storage or safekeeping and for which a fee for the services provided is

charged are covered.

31–“Auto” Dealers Autos (Physical Damage Coverages)

This symbol is unusual because Item Six of the Auto Dealers Declaration is needed to explain it. The types of auto and interests covered are provided in Item six.

Manuscript Symbol

An additional manuscript symbol not mentioned in the Auto Dealers Coverage Form is available by adding endorsement CA 99 54–Covered Auto Designation Symbol. Symbol 32 is available for the Auto Dealers Coverage Form and the autos considered covered must be listed and described on the endorsement.

|

|

Example: Jane’s dealership displays the first automobile it ever sold. It is still in working condition but is driven only in parades and commercials for the dealership. Because it is insured on an antique auto policy, it is not covered for physical damage coverage on Jane’s Auto Dealers Coverage Form. The insurance company agrees to provide symbol 21 for liability and symbol 32 for physical damage. CA 99 54–Covered Auto Designation Symbol is attached with the wording, “Except for the 1950 Antiquemobile, any auto and the interests in those autos described in Item Six of the declarations." |

Related Court Case: Garage Liability Coverage Held Clearly Defined By Choice of Numerical Symbols

B. Owned Autos You Acquire After the Policy Begins

1. If Symbols 21–Any Auto, 22–Owned Autos Only, 23–Owned Private Passenger Autos Only, 24–Owned Autos Other Than Private Passenger Autos Only, 25–Owned Autos Subject to No-Fault, or 26–Owned Autos Subject to a Compulsory Uninsured Motorists Law are entered on the declarations, autos of the type described by such symbols that the named insured acquires during the policy period are also covered. This means that a newly acquired auto that does not match the symbol is not covered until the insurance company is notified.

|

Example: Lincoln Motors uses symbol 23 for covered autos liability coverages. When a one-ton stake truck is purchased during the policy year, there is no covered autos liability coverage for it until it is reported to the insurance company. When a Kia Soul is purchased during the policy year, it automatically has covered autos liability coverage and reporting it to the insurance company is not required. |

2. When symbol 27–Specifically Described Autos is used, new autos acquired during the policy period are covered either if the insurance company covers all vehicles the named insured already owns or if the new vehicle replaces a vehicle already scheduled. In either case, the named insured must inform the insurance company of the acquisition within 30 days of the date it was acquired.

|

Example: Lincoln Motors uses symbol 27 for physical damage coverage. All vehicles that are scheduled are covered for comprehensive coverage but not all have collision coverage. The Kia Soul and the one-ton stake truck both have comprehensive coverage for up to 30 days. Neither has collision coverage because not all vehicles on the schedule have collision coverage. Once reported to the company, the appropriate coverage can be added. |

C. Certain Trailers and Temporary Substitute Autos

When covered autos liability coverage is provided, two additional categories of vehicles are added as covered vehicles.

1. Utility trailers having a load capacity of 2,000 pounds or less and designed for travel on public roads are covered but only while being pulled by a covered auto.

Note: There is no requirement that the utility trailer is owned. This means that covered autos liability coverage applies to a utility trailer the named insured rents to transport a piece of machinery as long as the load capacity is 2,000 pounds or less.

2. If the named insured's covered, owned auto is temporarily out of service for repair or service or due to breakdown, repair, servicing, loss or destruction, a non-owned, temporary substitute for it is covered but only if the named insured uses that substitute with the owner's permission.

|

Example: All of Greatful Motors' autos are insured under CA 00 25–Auto Dealers Coverage Form using Symbol 22–Owned Autos. Karl, one of the partners, is given the opportunity to drive a newly introduced electric car that the manufacturer would like Greatful to consider selling. Karl strikes a pedestrian but has no coverage under Greatful Garage’s coverage form because the electric car is not a substitute vehicle. |

Note: Cars temporarily substituting for owned vehicles being repaired, maintained, or serviced are covered.

|

Example: All of Greatful Motors' autos are insured under CA 00 25–Auto Dealers Coverage Form, using Symbol 22–Owned Autos. Karl, one of the partners, returns his electric car to the manufacturer for repairs. The manufacturer provides him with a substitute vehicle until the repairs can be completed. When Karl strikes a pedestrian, coverage applies because the vehicle is a substitute for a covered vehicle. |

|

D. Covered Autos Liability Coverage

1. Coverage

The insurance company pays amounts an insured is legally obligated to pay

as damages because of bodily injury or property damage. The bodily injury or

property damage must be caused by an accident. The accident must result from a

covered auto’s being owned, maintained or used.

The insurer also pays for certain pollution costs and expenses this

insurance covers when caused by an accident and resulting from the ownership, maintenance, or use of covered

autos. It only pays covered pollution costs and expenses if there is covered

bodily injury or property damage caused by the same accident.

|

Example: Greystoke

Auto Dealers owns a shuttle that transports customers who have left their

cars for service. The shuttle strikes an SUV as it exits the parking lot. The

SUV is upended, falls over, and its gas tank ruptures and spews fuel all over

the street, sidewalk, and the storefront of a neighboring restaurant. The

city sues Greystoke for the expense of

cleaning up gas residue, and the restaurant sues

for the cost of removing gas smells from its awning. The pollution costs and

expenses would be covered. |

|

|

Now,

let’s change this scenario slightly.

|

Example: Greystoke Auto Dealers owns a shuttle that transports customers who have left their cars for service. It strikes an SUV as it exits the parking lot. The shuttle driver gets his customers out of the vehicle and then rushes to remove a spare can of fuel from the shuttle before its damaged engine catches fire. He places it on the sidewalk for safekeeping. Later, forgetting it was there, he trips over it and falls. The can's loose lid allows five gallons of gas to spill onto the sidewalk and into a sewer drain. The city sues Greystoke for the expense of cleaning up gas residue. This loss is not covered. |

The insurance company has the right and duty to defend any insured against suits seeking damages this insurance covers. The insurance company decides how to handle its obligation and has the right to decide what to investigate, whether the claim is valid, and whether settling the claim or contesting it is appropriate. Its obligation ends once an action is resolved by a settlement, a court award, or exhaustion of the limit of insurance that applies.

Note: This covered autos liability coverage is similar to that provided in CA 00 01–Business Auto Coverage Form with respect to ownership, maintenance, or use of covered autos.

Related Article: CA 00 01–Business Auto Coverage Form Analysis

2. Who Is an Insured

Insureds for covered autos are:

a. The named insured

b. Anyone else who uses a covered auto the named insured owns, hires or borrows with the named insured’s permission except:

- The owner or anyone else from whom the named insured hires or borrows a covered auto. This does not apply when the covered auto is a trailer connected to an owned covered auto.

|

Example: If the named insured rents a car from a rental agency, the rental agency is not considered an insured. However, when the named insured rents a utility trailer to move furniture, the trailer owner is considered an insured. |

- The named insured's employees when auto is owned by the employee or a member of his or her households

|

Example: If the named insured borrows an employee's car to pick a client up at the airport, the employee is not considered an insured. |

- Anyone who is using a covered auto while working in the business of selling, servicing or repairing autos, unless it is the named insured's operation

- The named insured's customers. There are two exceptions

- If the named insured's customer does not have other insurance, the customer is an insured but only up to the compulsory or financial responsibility limits required by law in the state where the covered auto is principally garaged.

- If the named insured's customer has other insurance but its limits are less than the compulsory or financial responsibility limits required by law in the state where the covered auto is principally garaged, the customer is an insured but only for the difference between the limits carried and the mandated limit.

Related Court Case: Dealer’s Garage Liability Insurance Did Not Cover Customer As "Insured" Who Carried Own Insurance

- The named insured's partners, or members for a covered auto he or she, or a member of his or her household, owns.

c. Anyone who is liable for the conduct of an insured described above. Coverage is limited to only the extent of that liability.

d. An employee of the named insured while using

a covered auto that is not owned, hired or borrowed by the named insured but

only when using it in the named insured’s business or personal affairs

|

|

Example: Jim is the body shop manager for Marshall’s New Motors. Lana Marshall asks Jim to pick up her daughter from the airport. Jim takes his own auto and picks her up but, on the way to the Marshalls’ home, strikes a pedestrian at a crosswalk. The injured person sues Jim and Marshall Motors. Both qualify as insureds in this loss. |

Note: CA 99 33–Employees

As Insureds is necessary to provide this insured status under the BAP but it is

standard within this coverage form, so the CA 99 33 is not required.

3. Coverage Extensions

a. Supplementary Payments

The insurance company pays the following on behalf of the insured:

(1) All expenses the insurance company incurs.

(2) If a bail bond related to a covered accident is required, up to $2,000 is available to pay its cost. The bond could be for a traffic law violation if it is related to the covered accident. The insurance company is not required to furnish the bond.

(3) The cost of bonds needed to release attachments in a suit filed against the insured that it defends. The cost is limited to the amount of such bonds within the limit of insurance.

(4) Reasonable expenses incurred by an insured when requested to participate in any investigation or defense. Loss of earning is one of those expenses, but it is limited to the actual earnings lost due to time off work subject to $250 a day.

(5) All costs taxed against the insured in a suit filed against it that the insurance company defends. The exception is that attorney’s fee and attorney’s expenses taxed against the insured are not included.

(6) Interest accruing on the entire final judgment is covered. Once the insurance company offers to pay, deposits payment with the court, or pays its part of the judgment, any additional interest that accrues is not covered.

None of the supplementary payments reduces the limit of insurance. This means that the limits remain available to pay for the actual injuries or damages.

b. Out-Of-State Coverage Extensions

This section provides two important coverage extensions when an insured is away from the state where the auto is licensed. They essentially make the insurance provided comply with any state financial responsibility law, no-fault or other compulsory coverage. The two extensions are:

(1) The limit of insurance provided is automatically increased as needed to meet the limits required by a compulsory or financial responsibility law in the jurisdiction where the covered auto is being operated. An important note to this extension is that it does not apply to any law governing motor carriers, passengers or property.

|

Example: Percy’s auto dealer covered autos liability limit is $50,000. It complies with the financial responsibility laws of the state where the vehicle is licensed and garaged. However, that limit is inadequate when Percy drives across the state line into the next state that has a minimum limit requirement of $75,000. This extension automatically increases the limit to $75,000 while Percy drives in that state. |

(2) The Auto Dealers Coverage Form provides the minimum amounts and types of other coverages required of out-of-state autos by the state where the covered auto is operated. One such coverage is no-fault.

|

Example: Percy’s state does not require no-fault coverage, but a neighboring state where Percy often travels does. This extension provides the coverage that state requires when Percy drives there. |

Note: A statement here clarifies that the insurance company does not pay anyone more than once for the same elements of loss because of these extensions. In other words, it does not duplicate any coverage or allow damages to be collected more than once.

4. Exclusions

It is important to read these exclusions to determine what is excluded and to also carefully consider any exceptions to them.

a. Expected or Intended Injury

Any bodily injury or property damage caused by an insured’s deliberate actions is excluded.

Note: This exclusion is intended to protect insurance companies from responding to damages or injuries the insured causes intentionally. It is in the public interest to prevent the insurance coverage from being used for gain, to injure competitors, as an instrument of revenge, or to cause any other deliberate harm. There is no ISO endorsement available to buy coverage for intentional acts or to delete this exclusion at the present time.

b. Contractual

Damages that result from liability the insured assumed in a contract or agreement are excluded. There are two exceptions:

- Coverage applies if the liability would have existed without the contract.

|

Example: Jerry Careful is always transferring risk away from him.

When he buys a car from Great Auto Dealership, he requires that Great Auto

sign a contract that it if one of Great Auto’s employees causes an accident

while test-driving Jerry’s car that Jerry would not be liable for the

accident. This contractual liability is covered because the situation is

already covered. |

- Coverage also applies if the contract meets the definition of an insured contract. When the contract is an insured contract, coverage exists only if the loss occurred after the agreement had been made.

Note: There is no ISO endorsement available to buy back or delete this exclusion at the present time.

c. Workers Compensation

Coverage does not apply to any requirement or obligation the insured or its insurance company must assume due to any workers compensation, disability benefits, unemployment compensation, or similar law.

Note: This exclusion and the one that follows are intended to prevent double indemnification for an injury that should be covered under workers compensation or employers liability policies.

Insurers and brokers having to provide coverage on a variety of difficult, unusual or specialty workers compensation situations should refer to the Workers Compensation section in The Insurance Marketplace, a publication of The Rough Notes Company, Inc.

d. Employee

Indemnification and Employers Liability

Bodily injury to an employee that results from the actual employment or performance of duties that relate to the insured’s business is excluded.

|

Example: Maury worked as a mechanic for Lavid Motors. He specialized in brakes and sues Lavid

when he develops asbestosis because asbestos was in the brake linings he

worked on. Lavid’s insurance company

denies coverage. |

|

Bodily injury to the spouse, child, parent, brother or sister of the employee or the person described in the first section of this exclusion that is consequential to that person’s or employee’s bodily injury is also excluded.

|

Example: Maury’s wife helps to care for him. She injures her back when he falls, and she attempts to lift him up. She sues Lavid Motors because her injury is a consequence of Maury’s injury. Lavid’s insurance company denies coverage. |

The exclusion applies whether the insured is liable as an employer or in any other capacity, or whether the insured is obligated to share damages with or repay someone else who must pay damages because of the injury.

Note: This exclusion is also important because of the widespread use of contractors, subcontractors, independent contractors, or leased employees, and much of the uncertainty with respect to who is responsible.

This exclusion has two

exceptions. Coverage does apply to bodily injury to domestic employees who are

not entitled to workers compensation benefits. Domestic employees are persons

who perform household or domestic work primarily for a residence premises. The

second exception is that this exclusion does not apply to liability assumed by an

insured in an insured contract.

e. Fellow Employee

It is important to remember that employees are considered insureds. As a result, exclusions c. and d. could be circumvented if the injured employee could sue the fellow employee who actually caused the accident. This exclusion prevents that workaround. Bodily injury to a fellow employee of the insured that occurs as a result of or in the course of that employee’s employment is excluded. Bodily injury to the spouse, child, parent, brother, or sister of the fellow employee consequential to the fellow employee’s bodily injury is also excluded.

There are two ways to modify this exclusion. CA 20 55–Fellow Employee Coverage can be used to eliminate this exclusion entirely. CA 20 56—Fellow Employee Exclusions for Designated Employees/Positions can be used to eliminate this exclusion for injuries caused by certain employees or positions.

f. Care, Custody or Control

Property damage to or covered pollution cost or expense to property the insured owns, rents, or occupies, property loaned to the insured, property it holds for sale or transports, or that is in its care, custody or control is excluded unless such liability was assumed in a sidetrack agreement.

The Auto Dealers Coverage Form protects the insured for its negligence and tort liability to others, not to damages or injury to the insured or its property. As such, it reinforces the need for the insured to maintain its premises and properties in good condition and to use reasonable care to prevent damage or injury, including damage to property in its care, custody, or control.

Note: A sidetrack agreement involves the owners of a premises and a railroad with respect to a railroad sidetrack (a transfer or access track) on the insured's premises. The railroad allows the owner of the premises to use the sidetrack as long as it guarantees the railroad access to the sidetrack and agrees to certain conditions of property maintenance. It may also contain specified conditions of hold-harmless between the owner and the railroad.

g. Leased Autos

Covered autos leased or rented to others are excluded. The only exception is when a covered auto is rented to a customer while his or her auto is left with the named insured to be serviced or repaired.

h. Pollution

The term “pollutants” is defined later in this coverage form and is

very important to this exclusion.

There is no coverage for any

bodily injury or property damage that is due to pollutant discharge, dispersal,

seepage, migration, release, or escape. This exclusion applies if the event

actually happens but also applies if the bodily injury or property damage is

because of a threat of an event or an allegation that the event happened.

This paragraph would exclude any and all

auto-related pollutant events. However, the following three paragraphs modify

this exclusion considerably and must be carefully reviewed.

(1) This paragraph explains that this exclusion

applies when the pollutants are in between the place they were and the place

they are going to be. The pollutants or the property that contains the

pollutants must be in one of the following circumstances:

- Being in

movement into or out of the covered auto

- Being

transported or towed by a covered auto

- Being in the

course or transit. The insured may be providing the transit, or the

transit may be provided by others on behalf of the insured

- Being in or

upon the covered auto while being treated, processed, stored, or disposed

of.

This portion of the exclusion has an exception. The exclusion does not apply if the pollutants are fuels, lubricants, fluids, exhaust gases, etc., that are part of the normal electrical, hydraulic or chemical function of the covered auto. In order for the exception to apply, the pollutants must have been within an auto part designed by the manufacturer to hold, store, receive, or dispose of the pollutants prior to the accident.

(2) This paragraph explains that the pollution exclusion applies prior to the pollutant generating property being moved to where the insured will move it either into or onto a covered auto. This paragraph does not have the same exceptions that apply to paragraph a.

(3) This paragraph explains that the pollution exclusion applies after the pollutant generating property has moved from the covered auto to its final delivery. This paragraph does not have the same exceptions that apply to paragraph (1).

Paragraphs (2) and (3) of this exclusion do contain an important exception. The pollution exclusion does not apply if an accident occurs away from any owned or rented premises and the pollutants are not in or on a covered auto. This applies only if the property that generates the pollutant is upset, overturned, or damaged as a result of maintenance or use of a covered auto and the polluting event is caused directly by an upset, overturn, or damage.

|

Example: Paul, a sales representative, with Miracle Motors, is driving an auto from the dealership when he loses control and crashes into the outside oil tank at Jimmy’s Convenience store. The tank ruptures and releases all of its contents. Because the tank is not on the dealership’s premises and the release is caused by damage to the tank, the pollution release is covered under Miracle's Auto Dealers Coverage Form. |

Notes:

It is important to point out that this exclusion DOES NOT apply when a covered auto strikes another vehicle and the damages to that other vehicle result in a pollutant event.

Insurers and brokers that provide coverage on a variety of difficult, unusual or specialty pollution situations should refer to the Environmental Risks section in The Insurance Marketplace, a publication of The Rough Notes Company, Inc.

CA 99 55–Pollution Liability–Broadened Coverage for Covered Autos–Auto Dealers Coverage Form provides a buyback for pollution coverage. It changes the pollution exclusion by excluding only liability the insured assumes under a contract or agreement.

Related Article: Auto Dealers Coverage Form Available Endorsements and Their Uses

Related Court Case: Absolute Pollution Exclusion Held Applicable To Allergic Reaction to Paint and Glue Fumes

i. Racing

There is no coverage for any auto while it is being used in, practicing or being prepared for any professional or organized racing, demolition contest, or stunts.

Note: Bear in mind that this exclusion applies only to professional or organized racing. Spontaneous racing activities are covered although the expected or intended exclusion may be considered when spontaneous activities become dangerous.

|

Example: The three auto porters at Kinnley’s Auto dealership are becoming very competitive. It started when Kelly said she could move a car into position in 10 minutes, and then Tom said he could do it in nine and then Jerry got it down to eight. The battle continued until Kelly lost control of a vehicle attempting to break the five-minute mark. The damage caused by Kelly’s action is covered even though she was competing. When the insurance company learns of the competition, they might argue that Kelly actions should be excluded because she should have expected an accident to result from the speed. |

j. Handling of

Property

This exclusion works in conjunction with general liability coverage so that no duplication of coverage applies. This exclusion states that no coverage is in place for bodily injury or property damage resulting from the handling of property until that property has been physically moved to the point or place where the insured accepts it to be moved into or on the covered auto. The general liability coverage provides coverage until the property is moved to that point and after the property has been delivered. This exclusion states that covered autos liability coverage ends once the property is moved from the covered auto at the point where the insured makes the final delivery.

No coverage exists for bodily

Injury or property damage connected to property

prior to it being taken from the spot where an insured has taken control of it for

placing that property in or on a covered auto. The barring of coverage then is

reestablished at the point it is taken off or removed from a covered auto at

the point an insured has made final delivery.

k. Movement of

Property by Mechanical Device

Bodily injury or property damage caused when property is handled or moved by any type of mechanical device is

excluded. There are two exceptions. Coverage still is granted for injury or

damage related to moving property via hand truck or when handling property with

a device/mechanism that is attached to a covered vehicle.

l. Defective Products

There is no property damage coverage when a product of the

named insured’s is defective at the time that product is transferred and as a

result of that defect the property damage occurs.

Note: This is identical to the same-named exclusion in Section II – General Liability Coverages.

m. Work You Performed

Property damage to the named insured’s work or any part of it is excluded when it is the result of any part of the work itself or from any parts, materials or equipment that are used in connection with the work.

Note: This is identical to the same-named exclusion in Section II – General Liability Coverages.

n. Damage to Impaired Property or Property Not Physically Damaged

The insurance company does not cover property damage to impaired

property or property that has not been physically injured when it is caused by

a defect, inadequacy, or dangerous condition in either the named insured’s

product or its work. Coverage also does not apply if the damage is caused by a

delay or failure by the named insured or others who act on its behalf to meet

contract terms and conditions.

However, this exclusion does not apply to loss of use of other property

that arises out of the sudden and accidental physical injury to the insured’s products

or work performed by the insured if such loss or damage takes place after it has been put to its intended use.

Notes:

This is identical to the same-named exclusion in Section II – General Liability Coverages.

There is no standard ISO endorsement currently available to buy back this coverage or to delete this exclusion.

o. Products Recall

There is no coverage for damages claimed for any loss, cost or expense the named insured or others incur for loss of use, withdrawal, recall, inspection, repair, replacement, adjustment, removal or disposal of the named insured’s product. There is also no coverage if the claims for damages are due to work the named insured performed, or other property of which the named insured's work or product is a part when withdrawn, recalled or removed because of a known or suspected defect, deficiency, inadequacy or dangerous condition.

Note: This is identical to the same-named exclusion in Section II – General Liability Coverages.

p. War

This exclusion unequivocally bars coverage for either bodily injury or property damage related to war and similar military events. It is not affected by circumstances such as a formal declaration of war, that the war is a civil uprising, or whether it involves government or civilian participants.

Note: The bottom line is that there is no coverage for loss related either directly or indirectly to war or warlike activity. This exclusion unequivocally bars coverage for either bodily injury or property damage related to war and similar activity.

q. Acts, Errors or Omissions

What happens when a named insured is responsible for an act, inaction or error which causes injury to another party or another’s property? As far as the Auto Dealers Coverage Form covered auto liability goes, nothing. Such incidents are not covered.

Note: Limited coverage may be found in Section III – Acts, Errors or Omissions Liability Coverages.

5. Limit of

Insurance–Covered Autos Liability

This limit item applies only to accidents resulting from covered auto.

The most that is paid for the total of all damages resulting from all bodily injury and property damage in any one accident is the each accident limit on the declarations. This applies without regard to the number of covered autos, insureds, premium paid, claims made, or vehicles involved in the accident.

When damages and covered pollution costs or expenses are payable under this limit, they are not payable under Section II – General Liability Coverages or Section III – Acts, Errors or Omissions Liability Coverage.

Bodily injury, property damage and covered pollution cost or expenses that arise from exposure to or continuation of similar conditions are considered to be resulting from a single accident and therefore subject to a single limit of insurance.

A final statement in this limits item is that no party can receive duplicate payments for essentially the same loss under this coverage form and any medical payments, uninsured motorists or underinsured motorists coverage that is part of this coverage form.

|

Example: The two named insureds on the Auto Dealers Coverage Form are Smith, Inc. and John Smith, Smith Inc.'s owner. Smith, Inc. owns several private passenger vehicles that John uses for both business and pleasure. John causes a serious accident while using one of them on a personal errand. Because of the severity of her injuries, the injured party sues John individually for $500,000 and Smith, Inc. as the vehicle owner for $500,000. The Auto Dealers Coverage Form's limit is $500,000 Each Accident. The claimant is awarded $1,000,000, or $500,000 from each party named in the lawsuit but the Auto Dealers Coverage Form pays only its $500,000 limit. |

E. Garagekeepers Coverage

1. Coverage

a. The insurance company pays amounts the insured is legally obligated to pay as damages for loss or damage to either a customer's auto or its equipment that is left in the insured's care while attending, servicing, repairing, parking or storing it in the named insured's auto dealer’s operations.

Related Court Case: Dealership Acted Responsibly As Depositary of Owner's Automobile

There are three coverages options. The selection of the coverage is made on the declarations by displaying a limit next to coverage.

(1) Comprehensive Coverage

Coverage applies to any cause of damage to a customer's auto except for a collision with another object or an overturn of that auto.

(2)Specified Causes of Loss Coverage

This coverage applies only to loss or damage caused by or resulting from fire, lightning, explosion, theft, mischief, or vandalism.

(3) Collision Coverage

This coverage is very specific. The only covered loss or damage are those caused by the customer's auto's collision with another object or its overturn.

Note: Another object could be another vehicle as well as an animal, bird, person, tree, building or sign, to name a few.

b. The company has both the right and the duty to defend any insured against suits seeking these damages if coverage applies. It can investigate and settle claims and suits in the appropriate manner but its duty to defend ends when the limit of insurance for the coverage that applies is exhausted by payment of judgments or settlements.

2. Who Is an Insured

The insured for loss or damage to customers’ autos and their equipment is the named insured. Its partners and members are insureds but only as related to the named insured’s auto dealer operation. Limited liability company managers are insureds while performing their duties as managers. Executive officers and directors are insureds but only within their duties as such. Stockholders are insureds but only for any liability that might be imposed because they are shareholders.

Employees of the named insured are insureds while acting within the scope of their employment. They are also insureds while performing a duty that is related to the named insured auto dealer operation.

3. Coverage Extensions

The insurance company pays the following supplementary payments for the insured. They apply to any claim or suit it defends and do not reduce the limit of insurance.

a. All expenses it incurs.

b. The cost of bonds needed to release attachments in a suit filed against the insured that it defends, but only the amount of such bonds within the limit of insurance

c. Reasonable expenses if it asks the insured to participate in any investigation or defense. This includes actual loss of earnings up to $250 a day because of time taken off from work.

d. All costs taxed

against the insured in a suit filed against it that it defends, except for

attorney’s fees and expenses taxed against the insured.

e. Interest on the

full amount of any judgment that accrues after it is entered in a suit against

the insured that it defends. The duty to pay interest ends after the company

offers the part of a judgment that falls within its limit of insurance.

4. Exclusions

a. Coverage does not apply to any of the

following:

(1) Contractual

Liability that results from any contract or agreement wherein the

insured accepts responsibility for a loss is excluded,

unless the insured would be liable for

the loss without a contract or agreement.

(2) Theft

Coverage does not apply to loss due to theft or conversion caused in any way by the named insured, its employees, or shareholders.

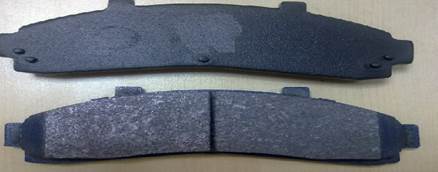

(3) Defective Parts

Loss caused by or resulting from the use of defective parts or materials is excluded.

(4) Faulty Work

There is no coverage for loss caused by or resulting from the named insured's faulty work performed.

b. Loss to any of the following types of property is not covered:

(1) Sound equipment that is not permanently installed in the vehicle. Tape decks, compact disc players, and new types of sound reproducing equipment are examples.

(2) Media used to produce sound in sound reproducing devices. Compact discs, cassettes, and new types of media are examples.

(3) Equipment that is not permanently installed but is designed to receive sound. Citizens’ band radios, two-way mobile radios, telephones, or scanning monitor receivers, including their antennas, and any accessories are examples unless they are permanently installed.

Note: CA 99 59–Garagekeepers Coverage–Customers' Sound Receiving Equipment covers this type of equipment and essentially deletes exclusion (3).

(4) Equipment that is designed or used to detect, locate, or jam radar or any other speed detection devices.

Note: There is no reference to increasingly common and sophisticated computing, visual and/or navigational devices.

c. Coverage does not apply to loss or damage

caused by or resulting from the following, regardless of any other cause or

event that contributes concurrently or in any sequence to the loss.

(1) War. This includes civil war and undeclared war.

(2) Warlike actions by military forces. This includes actions by any government, sovereign or other authority that uses military personnel or other agents to hinder or defend against actual or expected attacks.

(3) Action taken by a governmental authority to hinder or defend against insurrection, rebellion, revolution or usurped power and also the insurrection, rebellion, revolution or usurped power.

5. Limits of Insurance

and Deductibles

a. The most paid for each loss at each location is the limit on the endorsement schedule for the location for the coverages provided. This limit applies regardless of the number of customer’s autos, insureds, claims, suits or premium paid. The deductibles that apply to the loss must be subtracted from the amount claimed prior to applying the limit cap.

Note: An important

point for the named insured to consider in selecting the limit is the total

number of vehicles in its care at any one time and their associated values.

|

Example: A fire damages four customer vehicles at Handy’s Used Car Lot, for total damages of $65,000. Because Handy’s Garagekeepers limit is $50,000, only $50,000 is paid. |

The deductibles that apply to a loss must be subtracted from the amount claimed prior to applying the limit cap. Deductibles apply to loss involving collisions, other than collision coverage or, when selected, specified causes of loss (either all perils or theft/mischief/vandalism).

|

|

Example: Hail damaged 25 customers’ vehicles at Small Town Dealership. Small Town had a $100,000 limit with a $500 per-vehicle, $2,500 per-occurrence comprehensive deductible. The loss amounted to $110,000. This amount was reduced by the $2,500 per-occurrence deductible to $107,500 but the insurance company paid only the $100,000 limit. |

b. The deductible

for Garagekeepers Coverage Comprehensive or Specified Causes of Loss Coverages

on the declarations is the most deducted for all loss in any one occurrence.

c. Depending on the nature of a given loss, the insurance company may have to settle a claim quickly for the entire amount, including the value of any deductibles that might apply. Doing so does not void the insured's responsibility to absorb the deductible. In these cases, the insured must reimburse the insurance company for the value of any deductible it paid.

F. Physical Damage Coverage

1. Coverage

The insurance company

pays for loss to a covered auto, its equipment based on the coverages on the

declarations, and the symbols selected. When selected, the following coverage

is provided:

(1) Comprehensive

Coverage

This is loss or damage from any cause except situations where the covered auto collides with another object or when the covered auto overturns.

(2) Specified Causes of

Loss

This is loss or damage caused by fire, lightning, explosion, theft, windstorm, hail, earthquake, flood, mischief, vandalism. Loss or damage caused to the covered auto that is being transported when the transport conveyance sinks, burns, collides, or is derailed is also covered.

Note: Although these are the most common losses that happen to auto, the causes are very specific which means that many losses may not be covered, such as animals crawling into an auto, ash and other damage due to volcanic eruption, acidic bee droppings, glass cracking due to extreme heat and more.

(3) Collision Coverage

This is loss or damage caused when the covered auto collides with another object or overturns.

Note: "Another object" does not mean only another vehicle. It could be an animal, bird, person, tree, building, sign, and any item that can be struck.

b. Glass Breakage–Hitting a Bird or Animal–Falling Objects or Missiles

This item applies only if Comprehensive Coverage applies to the damaged covered auto.

The insurer pays the following losses under Comprehensive coverage:

- Glass breakage

- A loss that occurs when an animal or bird is hit

- A loss that occurs because of falling object or missile

When glass breakage is part of a collision loss, the insured has the option to have the loss paid as either collision or comprehensive.

Note: This item clarifies coverage. The three types of losses discussed could be called collisions because an object struck the vehicle. This is important because of the differences in deductibles and in coverage. When collision coverage is provided, its deductible is often significantly higher than the comprehensive deductible. In addition, there may be times when comprehensive is the only physical damage coverage carried on the auto.

2. Coverage Extension–Loss of Use Expenses

This is a conditional extension. It applies only if all of the following conditions are met:

- Hired Auto Physical Damage coverage applies

- An insured rented or hired a vehicle using a written contract or agreement

- The contract makes the insured legally liable for damage to the rented vehicle

- The vehicle rental does not include a driver

A payment of no more than $20 per day is provided for the loss of use of a rented vehicle but only if the loss was caused by Comprehensive, Specified Cause of Loss or Collision coverage for which a symbol 8 is entered on the declarations. This loss is capped at $600.

Note: CA 99 90–Optional Limits–Loss of Use Expenses can be used to purchase higher limits.

3. Exclusions

Editor’s note: Some exclusions are given titles for analysis purposes. These titles are not a part of the Auto Dealers Coverage Form.

a. Anti-concurrent

Causation Exclusions

Coverage does not apply to loss or damage caused by or resulting from the following, regardless of any other cause or event that contributes in any way or in any sequence of events to the loss.

(1) Nuclear Hazard

This is an explosion of any weapon using atomic fission or fusion, or nuclear reaction, radiation or radioactive contamination, regardless of how caused.

(2) War or Military Action

This includes declared or undeclared war, civil war, and warlike action by a military force, including acts to defend or hinder an expected or actual attack by any government or authority employing military personnel or agents, as well as insurrection, rebellion, revolution, usurped power or any action to hinder or defend against these.

Note: Damage or loss involving nuclear or war-like activities is excluded even if other loss factors contribute to an incident. In other words, these losses are excluded regardless of how caused or whether or not they combine with any other cause of loss.

b. The insurance company does not pay for loss or damage to the following:

(1) Leased or Rented

Autos

Covered autos leased or rented to others are excluded. The only exception is when a covered auto is rented to a customer while his or her auto is left with the named insured to be serviced or repaired.

(2) Racing

There is no coverage when a covered auto is being used in or practicing or being prepared for any racing, demolition or stunt activity that is professional or organized.

Note: Racing, demolition, or stunt activities that are spontaneous and totally unprofessional would be covered.

(3) Tapes, Records,

Discs

Tapes, records, discs and similar property or devices that are designed for use with audio, visual, or data electronic equipment are excluded. This exclusion is extremely broad because of changes in media. Tapes and CD’s are excluded as well as DVD’s and equipment that can be attached to any media system within the auto.

Note: In this exclusion, ISO uses the term “data electronic” that is neither defined nor in common usage. The term is used to describe devices that are excluded and also to describe equipment to which any of these excluded items could be designed for. Although it appears to be an all-inclusive term, its lack of clear meaning could make this exclusion ambiguous.

(4) Speed Detection

Devices

There is no coverage for radar and laser jamming, detecting, eluding or disrupting equipment designed or used to detect speed.

(5) Electronic

Equipment

Coverage does not apply to any type of electronic equipment that is used to receive, reproduce, or transmit audiovisual or data. This exclusion applies even if the equipment it is permanently installed.

(6) Other Equipment

This is a continuation of item (5) above because any accessory that is used with the item (5) equipment is also not covered. Exclusions b. (5) and (6) do not apply to property that is designed to operate only from the auto’s electrical system and that at the time of loss meet any of the following criteria:

(a) The equipment is permanently installed in or on the covered auto

(b) While the equipment is not permanently installed the housing unit from which it can be removed is permanently installed in or on the covered auto

(c) Any item that is considered integral to items described in (a) or (b) above

(d) Other electrical equipment that is required in order for the covered auto to operate or that monitors the operating system

c. False Pretense

When the named insured voluntarily gives a third party a covered auto there is no coverage if a loss occurs because the third party used a trick, scheme or another type of false pretense to obtain the covered auto. There is also no coverage if a loss occurs because the named insured acquires an auto from a seller who has no legal title to it.

|

Example: Suburban Motors turns in two losses that are actually a single transaction. Charlie negotiated with Cindy to purchase her old Buick and use it as a down payment on a new model GMC. Cindy was a hard negotiator, but the deal was struck, and Charlie was content with the Buick. Unfortunately, Cindy’s check bounced and the title on the Buick was discovered to be false because the Buick had been stolen a month earlier. Suburban wants to be compensated for the value of the model GMC. Unfortunately for Suburban, no part of this loss is covered. |

Related Court Case:

False Pretense Exclusion in Garage Policy Unambiguously Excluded Coverage

Note: CA 25 03–False Pretense Coverage covers operations that receive used vehicles for trade-ins. It covers the insured up to the specified limit for vehicles it acquires from customers who engage in false pretense.

d. Additional

Exclusions

(1) Coverage does not apply to the named insured's expected profit, loss of market or resale value.

(2) The insurance company does not pay for loss to any covered auto that is stored or displayed at any location that is not on the declarations if the named insured has been using the location for 45 or more days.

Note: This means the named insured has a 45-day grace period for physical damage of autos at newly acquired locations. It also means that coverage applies to locations where vehicles are exhibited for short time periods.

|

Example: Kerry Motors sponsors activities at the Indiana State Fair and also exhibits seven vehicles as part of the Fair. Because the fair is less than 45 days, any physical damage loss that occurs would be covered. One year Kerry decides to keep using the location after the fair ended because of other activities taking place at the fairgrounds. That year Kerry used the location for 60 days. If a loss occurred during the final 15 days, Kerry would have had no coverage even if the autos at the location had only been at the location for a day. The time limit is based on the location use, not the time an auto is at the location. |

(3) Collision coverage applies to a covered auto that is being moved from the point of purchase/distribution to its final destination but only if the distance between the two points is 50 miles or less.

Note: CA 25 02—Dealers Driveaway Collision Coverage is available for dealers with driveaway exposures that go beyond the 50-mile limitation.

(4) Specified Causes of Loss coverage does not apply when loss or damage to any covered auto is the result of the vehicle transporting it being upset or colliding with an object.

(e). Diminution of Value

Loss of a covered auto's value because it was involved in an accident is not covered.

Note: Diminution of Value is defined in Section VI–Definitions.

f. Other Exclusions

Coverage does not apply to loss or damage caused by and confined to wear and tear, freezing, mechanical, or electrical breakdown. There is also not coverage for blowouts, punctures, or other road damage to tires. This exclusion does not apply if the loss is the result of a total theft of the vehicle.

4. Limits of Insurance

a. The most paid for:

(1) All loss or damage to a single covered auto that is damaged or stolen is the lesser of:

(a) The actual cash value of that property. This value is established as of the date of the loss and not as of the date of adjustment.

(b) The cost to repair or replace with items that are considered like it in kind and quality

(2) Reproducing, receiving, or transmitting

electronic equipment in a vehicle is a sublimit

of $1,000. Equipment subject to this sublimit

is permanently installed but in a place within or upon the auto that is not

where the manufacturer normally installs such equipment. It is also subject to

this sublimit if it is removable

equipment and its permanently installed housing is in a place that is not where

the manufacturer normally installs it. Any other items that are integral to the

equipment described in this paragraph are also subject to the sublimit.

b. In the case of a total loss, adjustments are made for the auto's depreciation and physical condition to establish the actual cash value.

c. If repairing or replacing the auto increases its value, the insurance company does not pay for that increase.

Note: CA 99 28–Stated Amount Insurance appears to be a way around this limitation. However, for vehicles on the endorsement schedule, the limit for physical damage coverage is changed to the least of the actual cash value, the cost to repair or replace, or the limit specified. This means this limitation would still apply. In fact, this endorsement should be used cautiously because it could actually decrease the settlement amount.

d. Additional

Provisions

(1) The most paid for all loss or damage at any

one location is the limit for that location in Item six on the declarations,

regardless of the number of covered autos damaged or that are involved in the

loss. Similarly, the most paid for all loss in transit is the limit on the

declarations for loss in transit, regardless of the number of covered autos

damaged or that are involved in the loss.

(2) Quarterly or

Monthly Reporting Premium Basis

When coverage is provided on a reporting basis, a penalty is imposed if the reports are not accurate. When a loss occurs, the last report is reviewed. If that report is less than the actual values at the location at the time of the report, a penalty is computed by dividing the reported value by the actual value. That percentage is then multiplied by the actual loss to compute the amount of loss to be paid.

|

Example: Merry Motors reports on a monthly basis. The June report was $575,000. A $51,000 loss occurs in July. It is reduced to $50,000 because of the $1,000 deductible. Careful Insurance Company investigates and discovers that the amount Merry should have reported in June was $700,000. This means that instead of paying the $50,000 loss, Careful pays $575,000 ÷ $700,000 X $50,000 = $41,071. |

If the first report is due but has not yet been made, the maximum paid is 75% of the location limit.

(3) Non-Reporting

Premium Basis

There is also a penalty for underinsurance when the location is written on a nonreporting basis. The limit on the Declarations for the location value is divided by the actual value of the covered autos at the loss location at the time of the loss. That percentage, if less than 1.00, is multiplied by the loss amount to arrive at the penalized loss.

Note: The deductible is applied before applying any

of the described penalties.

5. Deductible

The named insured must first pay the deductible amount showed on the Declarations toward any loss before the insurance company pays its portion of the loss. Comprehensive or Specified Causes of Loss Coverages can have a deductible for only theft and vandalism or for all perils. The per-loss deductible is capped at the maximum deductible indicated for that location on the declarations.

The collision deductible has only a per- loss deductible. There is no maximum.

SECTION II–GENERAL LIABILITY COVERAGES

A. Bodily Injury and Property Damage Liability

1. Coverage

a. The insurance company agrees to pay amounts the insured is legally

obligated to pay as damages for bodily injury and property damage that this insurance

covers, specifically such incidents connected to the auto dealer activities

that are not auto related. It also has the right and duty to defend the insured

against any suit that seeks those damages but only suits that seek damages that

this insurance covers. It can investigate any loss and settle any claim or suit

that results at its discretion but the amount it pays as damages is limited as described under Paragraph F. Limits

of Insurance.

The insurance company’s right and duty to defend ends when it uses up

the limit of insurance that applies to pay judgments and settlements under Paragraph

A. Bodily Injury and Property Damage Liability, Paragraph B. Personal and Advertising Injury Liability

or Paragraph C. Locations And Operations Medical Payments. The insurance company does not have any other obligation

or liability to pay sums or perform acts or services except for those

specifically listed and described under Supplementary Payments.

The payments must actually be made before the obligation to defend ends.

Related Court Case: Defense Obligation Ended When Court Determined Insurer Did Not Have Duty to Indemnify For Contamination

Note: Section II is similar to a CGL policy. The

coverage in this section does NOT respond to bodily injury or property damage

related to the ownership, use, or maintenance of autos.

|

Example: Happy Motoring, Inc. is sued by a customer who severely injures her back in a fall. Scenario 1: The injury occurs when she slips on a wet floor near the dealership’s entrance – eligible for coverage. Scenario 2: The injury

occurs when she trips while exiting an SUV on the dealership’s sales floor –

ineligible for coverage. |

b. Coverage applies to bodily injury and property damage subject to all three of the following:

· The accident takes place in the coverage territory.

· The bodily injury and/or property damage occur during the policy period.

Note: This means that the accident may or may not happen during the policy period and that the bodily injury or property damage may or may not take place in the coverage territory.

|

Example: Jared repaired Millie’s convertible in August. Neither

of them realized that Jared installed the exhaust pipe incorrectly and it was

piping the exhaust into the cabin of the vehicle. The accident was the

incorrect installation. In October Millie passed out while driving her

vehicle in Mexico and struck two other vehicles, injuring her and the drivers

of the other vehicles. The accident investigation uncovered Jared’s mistake.

The loss is covered because the accident (the incorrect installation) took

place in the coverage territory. Jared’s policy that is in effect on the day

Millie passed out is the policy that will respond to the accident. |

- Prior to the policy period, no insured (as found in items 1-4 in Section D) or employee who was authorized to give or receive notice of an occurrence or a claim was aware that the bodily injury or property damage had occurred.

|

Example: George was a partner

at Polished Vehicles. He retires on 6/12/19. On his last day, while working

with a customer named Sweetie, he rolls over her instep with his very heavy

desk chair. George forgets to mention this to his supervisor because Sweetie,

even though limping out of his office, claims she is fine. Polished Vehicles

changes to a new insurer on 6/20/19. They are surprised to see a claim filed

by Sweetie on 7/8/19. The new insurer denies the claim, advising Polished

that, because George had caused the loss, Polished Vehicles was aware of the

potential claim. It must be submitted to the prior carrier. |

If a prior knowledge claim as explained above is presented, any continuation, change, or resumption of such bodily injury or property damage claim during or after the policy period is also considered to have been known before the policy period.

|

Example: Sweetie’s husband files a claim for loss of consortium and expenses related to her loss of income and the need to hire extra help to aid with the children and her parents. Because this claim is related to Sweetie’s initial claim, it is also considered to have occurred in the prior year because of George’s knowledge of the initial accident. |

c. Bodily injury or

property damage that occurs during the policy period but that is unknown to an

insured (as found in items 1-4 in Section D) or employee who was authorized to

give or receive notice of an occurrence or a claim prior to the policy period to have occurred.

This includes any continuation, change, or resumption after the policy period

ends.

d. Bodily injury or property damage is

considered known at the earliest date when an insured (as found in items 1-4 in

Section D) or employee who was authorized to give or receive notice of an

occurrence or a claim:

- Reports any

part of any injury or damage to the current insurance company or any other

company

- Receives a

written or verbal demand or claim for damages

- First becomes aware in any other way that bodily injury or property damage either has occurred or has begun to occur

Related Court Case: Known Injury

or Damage Not Excluded In Continuous or Progressive Damage Loss

2. Exclusions

This insurance coverage does not apply to any of the following, except

as noted:

a. Expected or Intended Injury

Coverage does not apply to bodily injury or property damage that is

either expected or intended by the insured. This exclusion contains an

exception that covers bodily injury that results from the insured using

reasonable force to protect persons or property. It does not cover intentional

property damage, though.

Note: The primary reason for this exclusion is to keep the insurance company

from becoming involved with non-accidental losses and is in the public

interest. It ensures that the insured will not use the insurance coverage for

gain, such as theft, to inflict injury on a competitor, as an instrument of

revenge, or to cause any other intentional harm. This exclusion's wording

continues to be challenged and interpreted by the courts, especially in cases

where the action was intentional but the type and extent of injury or damage

that resulted was not.

Related Article: Expected or Intended Injury Exclusion

Related Court Case: "Expected or Intended Injury"

Exclusion Did Not Apply To Bar Patron's Injuries

b. Contractual Liability

There is no coverage for bodily injury or

property damage when the

insured has assumed liability in a written contract or agreement for such

bodily injury or property damage. There are two exceptions:

- Liability the insured would have had without a

contract or agreement

- Liability the insured assumed in an insured contract or agreement is covered. However,

the bodily injury or property damage must occur after the contract or

agreement is executed.

Note: A retroactive agreement is excluded because

it unfairly manipulates coverage.

|

|

Example: Oops Auto Sales has extra space that it leases out to a

gentleman who specializes in Upholstery Repairs. As part of their lease

agreement, they agree to hold him harmless for any injuries to customers

while in his part of the building. The agreement has no effect on Oops’ Auto

Dealer policy because it would be liable for such injuries regardless of the

lease. |

c. Workers Compensation and

Similar Laws

There is no coverage for any requirement or obligation of the insured

that is imposed by any workers compensation, disability benefits, unemployment

compensation, or similar law.

Note: The intent of this exclusion and the Employers Liability exclusion is to

eliminate the possibility of the insured being indemnified under this coverage

form for an injury that workers compensation or employers liability policies

cover.

Related Court Case: Employee Injury Exclusion Could Not Be Waived When Employer Failed to Carry Workers Compensation Insurance

d. Employee

Indemnification and Employers Liability

Bodily injury to an employee that results from the actual employment or performance of duties that relate to the insured’s business is excluded.

In addition, bodily injury to a person that arises from that person not being hired or being fired or subject to negative employment-related practices is also excluded.

Bodily injury to the spouse, child, parent, brother or sister of the employee or the person described in the first two sentences of this exclusion that is consequential to that person’s or employee’s bodily injury is also excluded.

This exclusion applies whether the insured is liable as an employer or in any other capacity, or whether the insured is obligated to share damages with or repay someone else who must pay damages because of the injury.

When an insured has assumed liability for such actions in an insured

contract, the first sentence above does not apply.

Note: This exclusion is particularly important because of the widespread use of contractors, subcontractors, independent contractors, or leased employees, and much of the uncertainty with respect to who is responsible for injuries to those individuals.

Related Articles:

Stop Gap–Employers’ Liability Coverage

e. Damage to Property

The insurance company does not pay for property damage to:

(1) Property

the named insured owns, rents, or occupies. Costs or expenses the named insured

or any other party incurs to repair, replace, enhance, restore, or maintain

such property for any reason are excluded. Costs to prevent injury to persons

or damage to property of others are also excluded.

(2) Property that is loaned to any insured

(3) Property that an insured possesses with the

intent to sell or to transport (including while it is being transported)

(4) Personal property in the insured's care,

custody, or control

|

Example: Harry Car Pavilion is damaged by a fire. Part of the

damage included a sales display of custom car waxing kits that were left

there via an agreement with the product’s vendor. That property is not

eligible for coverage under Harry’s policy. |

Related Court Case: Care, Custody or

Control Exclusion Held Applicable

Related Article: Care, Custody, or Control

Note: A coverage alternative for this exclusion is Inland Marine Insurance.

Bailees Coverage is available to cover property of the insured’s customers or

clients. Various forms of bailees coverage are available through ISO, the

American Association of Insurance Services (AAIS), and company-specific forms,

depending on the insured's needs and operations.

Related Articles:

AAIS Bailee Customers Floater Coverage–Dry Cleaners and Laundry

Form

AAIS Miscellaneous Bailee–Processor Floater

ISO Bailees Customers Coverage Form

Paragraphs (1), (2), and (4) above do not apply to property damage (other

than by fire) to a location (including its contents) that the named insured

rents for seven or fewer consecutive days. A separate limit applies as

described in Paragraph F–Limits of Insurance.

An exception is also made regarding any liability assumed under a

sidetrack agreement.

Note: Railroad sidetrack agreements are covered contracts.

f. Pollution

Note: Although this pollution exclusion is similar

to the CGL pollution exclusion, it is not identical due to the removal of one

on-premises exception and one off-premises exception.

Pollutants are defined in the definitions section as irritants or contaminants that

can be solid, liquid, gaseous, or thermal. Smoke, vapor, soot, fumes, acids,

alkalis, chemicals, and waste are listed as examples. The term waste

specifically includes materials that are intended to be recycled,

reconditioned, or reclaimed.

(1) Coverage does not

apply to any bodily injury or property damage that arises because pollutants

have been discharged, dispersed, seeped, migrated, released, or if they have

escaped. The events may have actually occurred, may have been alleged, or were

threatened. The exclusion applies under the following circumstances:

(a) At or from any location, site, or premises that the insured ever owned, occupied, rented, or had loaned to it.

(b) At or from any

location or site used to handle, store, dispose of, process, or treat waste.

This applies regardless of who was involved with the waste-related activity.

(c) At or from any

location or site where any insured is performing operations. This also applies

to contractors and subcontractors working for any insured. This applies if the

operations:

- Perform pollutant

testing, monitoring, cleaning up, removing, containing, treating,

detoxification, neutralization, response, or assessment in any way.

- Require that

the pollutants be brought to the location or site by the insured, contractor,

or subcontractor.

(d)

That

were transported, handled, stored, treated, disposed of, or processed as waste.

This applies only if the insured or someone the named insured is legally

responsible for was involved with the waste-related activity.

There are three exceptions:

- Bodily

injury or property damage that arises out of the heat, smoke, or fumes from a hostile fire, but the exception

applies only to item (1) (a) and the portion of item (3) that only related to pollutants brought onto the

premises by such insured, contractor or subcontractor.

|

Example: A fire breaks out in a kitchen/break room

in Grandiose Autos. The fire is put out, but not before also heavily damaging

a storage room that contained a variety of cleaning solvents. The fumes from

the burning storage room sicken several customers who were cleared from the

building when the fire was discovered. Treatment for their injuries would be

eligible for coverage. |

- Bodily injury that is sustained inside a building when the bodily injury is caused by smoke, vapor, fumes, or soot coming from equipment that heats water for the building's occupants. The water must be intended for only personal use. The exception applies only to item (1) (a).

- Bodily injury or property damage caused by the release of gases, fumes, or vapors from materials if those materials had been brought into the building as part of operations being performed by the named insured or by a contractor, or subcontractor who is acting on behalf of the named insured. An important part of this exception is that the injury or damage must be sustained within the building. This exception applies only to item (1) (c).

(2) Coverage does not apply to any loss, cost,

or expense that arises out of any:

(a) Request,

demand, order, or statutory or regulatory requirements the insured must comply

with regarding the effects of pollutants. These may involve the insured or

others testing for, monitoring, cleaning up, removing, containing, treating,

detoxifying, neutralizing, responding to, or assessing those effects.

(b) Claim or suit by or on behalf of a

governmental authority for damages due to testing for, monitoring, cleaning up,

removing, containing, treating, detoxifying, neutralizing, responding to, or

assessing the effects of pollutants in any way

Item f. (2). does not apply to any liability for property damage that

the insured would have outside of any such governmental authority.

Related Court Cases:

Contaminant Clarified With Respect To Application of Pollution

Exclusion

Pollution Claim by Insured for Damage to His Property by

Former Tenant Held Not Covered

Pollution Exclusion Applied Although Toxic Waste Was Turned

Over To Transporter for Disposal

g. Aircraft, Auto, or Watercraft

Coverage does not apply to bodily injury or property damage that arises

out of owning, maintaining, using, operating, loading, unloading, or entrusting

to others any aircraft, auto, or watercraft that any insured owns, operates,

rents, or has loaned to it. This exclusion applies even if a claim alleges that

any insured was negligent or engaged in wrongdoing in supervising, hiring,

employing, training, or monitoring others.

This exclusion has three exceptions. It does not apply to:

- Watercraft on

shore at locations the named insured owns or rents

|

Example: Amityville Autobarn was holding its Summerfun festival! They had several displays

including a small speedboat on a boat trailer that was parked on the Autobarn

lot. The boat and trailer belong to Autobarn’s principal owner. Several kids

climbed aboard the boat to play like pirates and two kids fell off, suffering

some severe cuts and broken limbs. Coverage applies to the injuries. |

- Watercraft